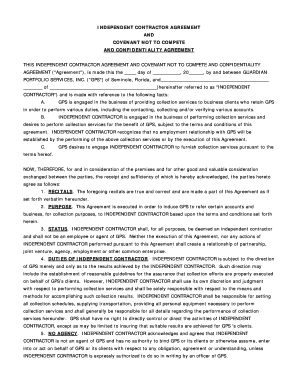

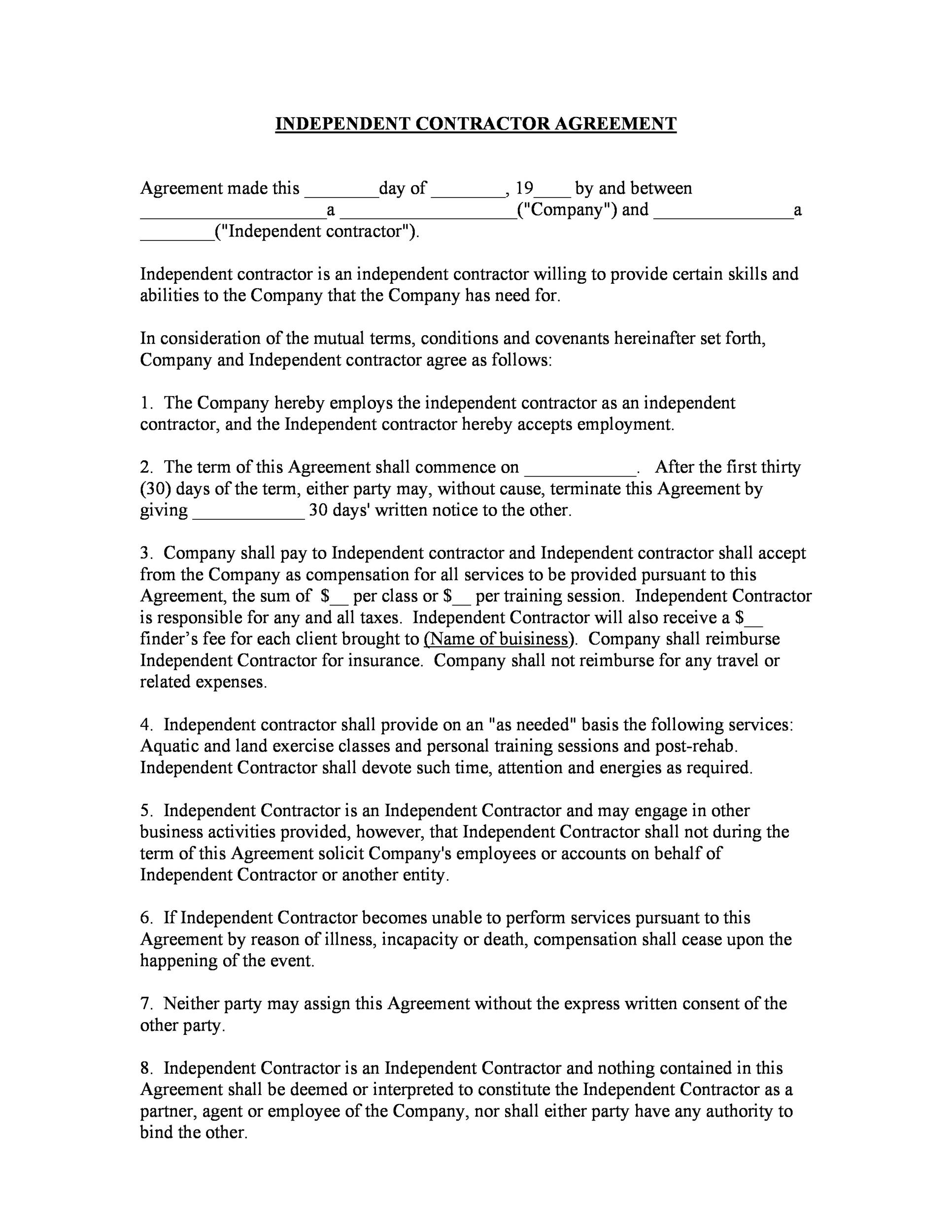

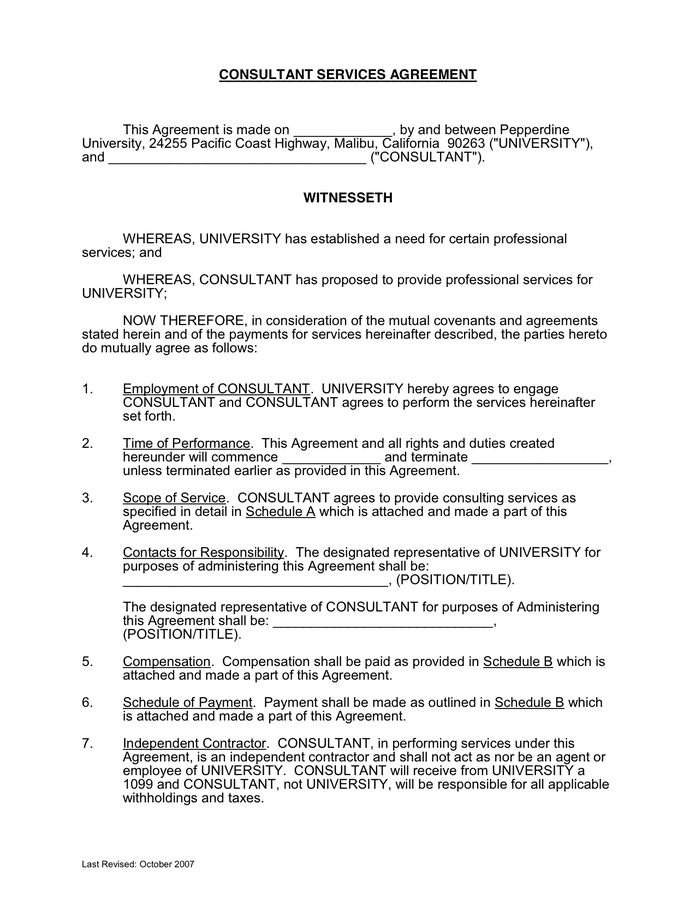

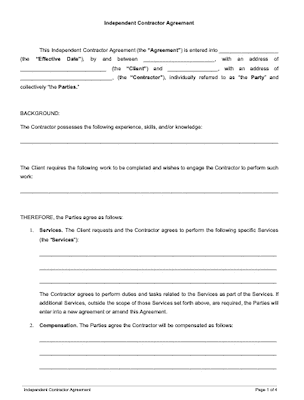

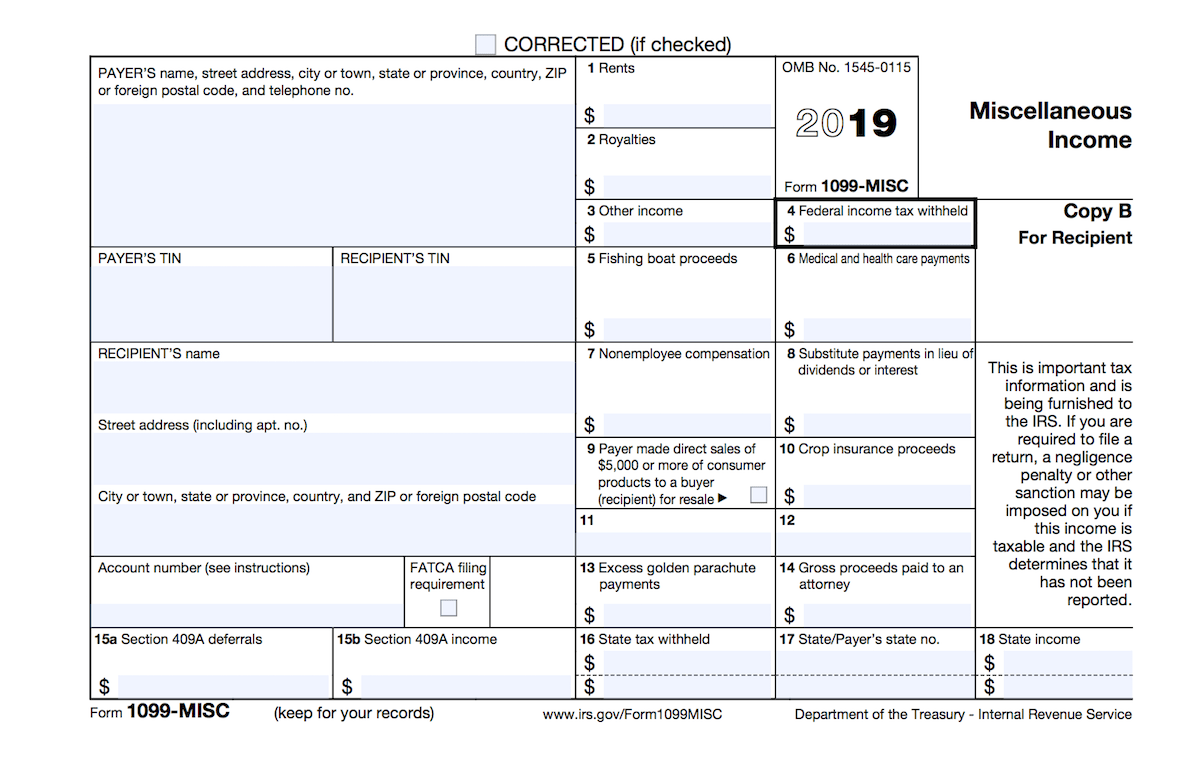

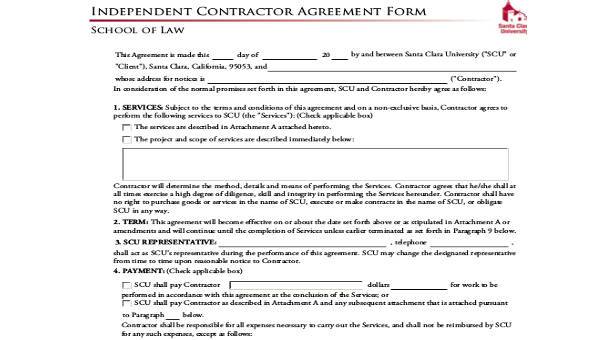

In fact, some independent contractors work below minimum wage His payment is typically assessed by the completion of a job, not by the hours worked — when a jobAs an independent contractor, you have the right to control what you work on and how it will be done Any independent contractor may receive at least one 1099 form every year Any jobs under $600 don't require a 1099, but the income must be accounted for As far as taxes are concerned, independent contractors have to pay their taxes in full1099 Form Independent Contractor Agreement It is required to dispatch a copy of IRS 1099 Form Independent Contractor Agreement to the respective personnel by January 31 of the year following the payment Also, it is to be noted that the independent contractors may have their own employees or may hire independent contractors under them

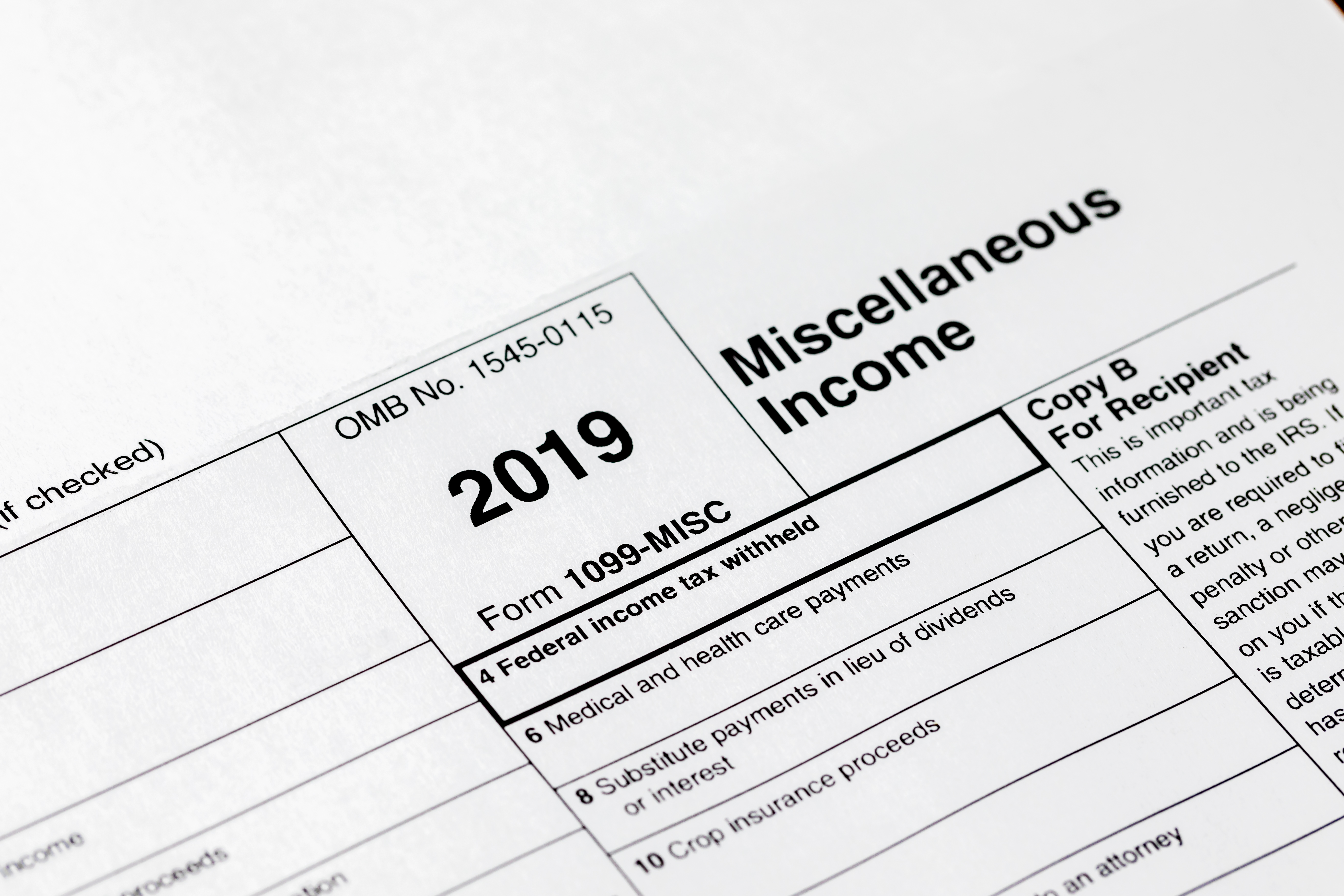

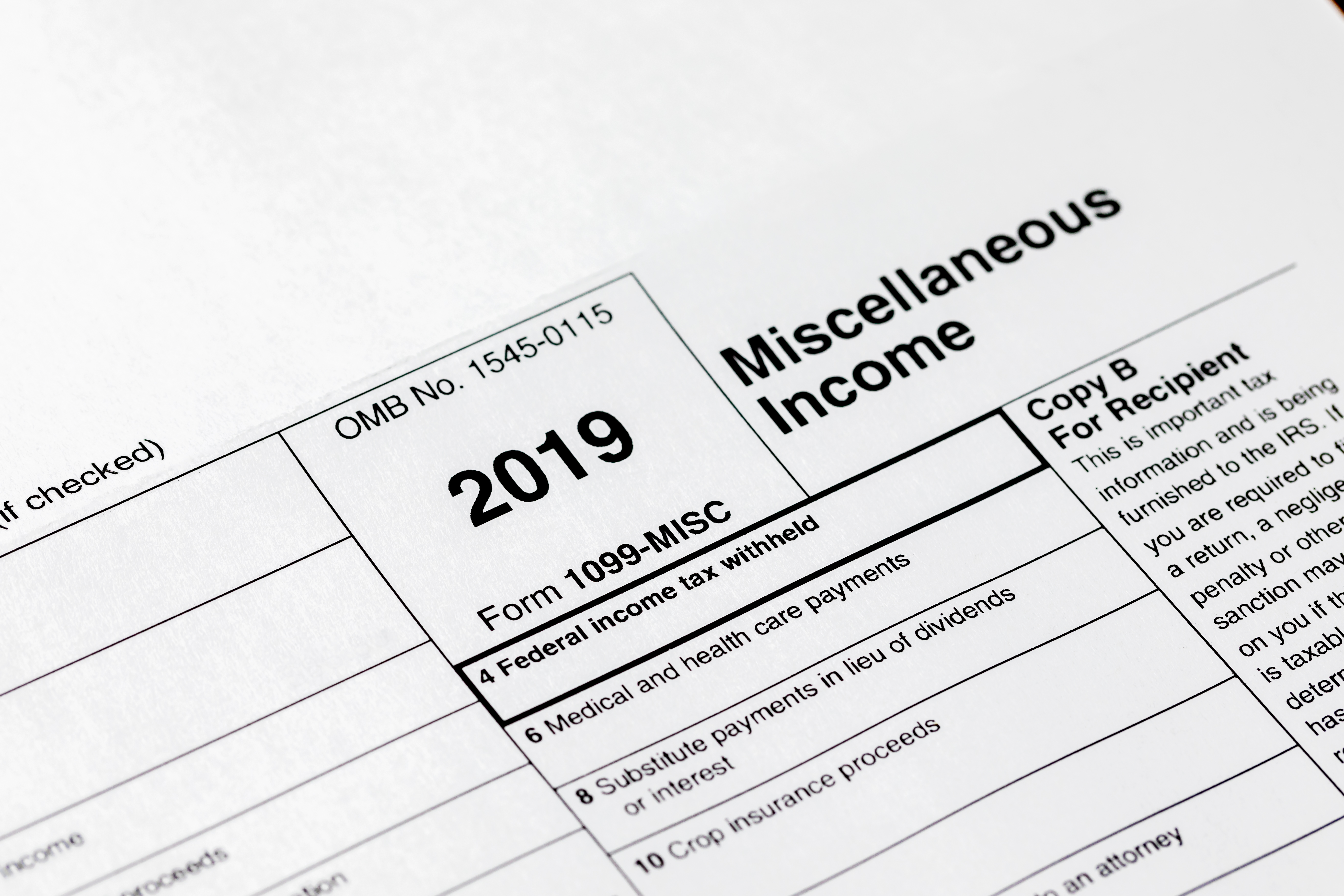

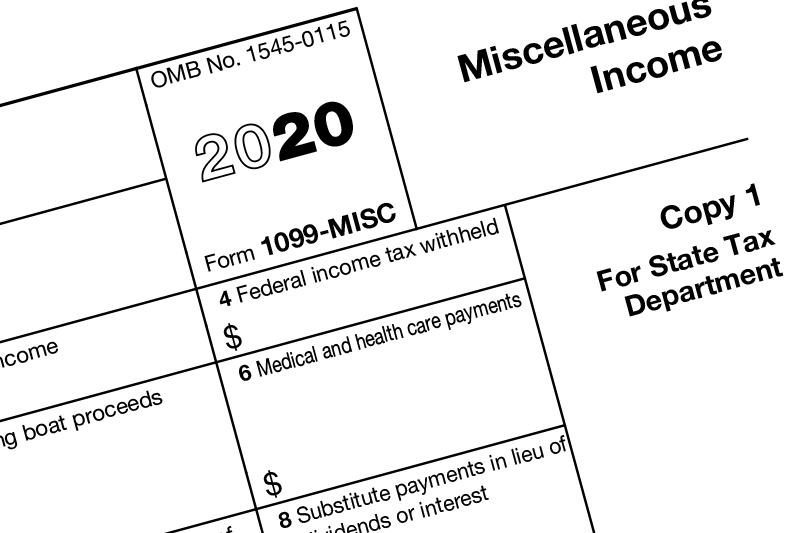

Who Receives A Form 1099 Misc

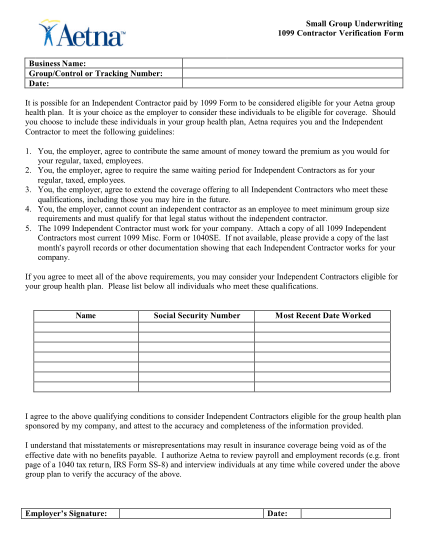

1099 contractor form editable

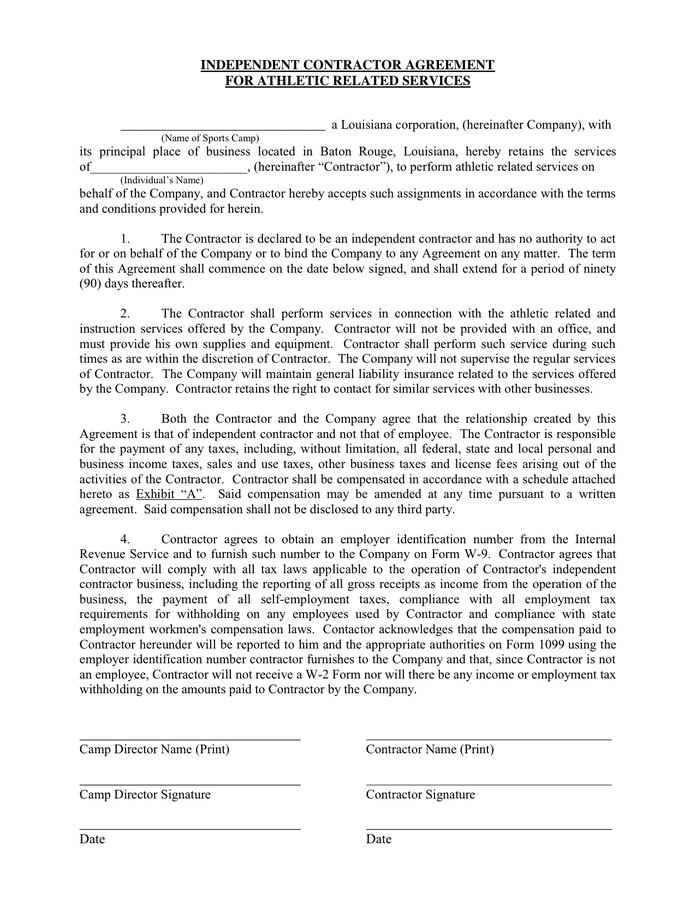

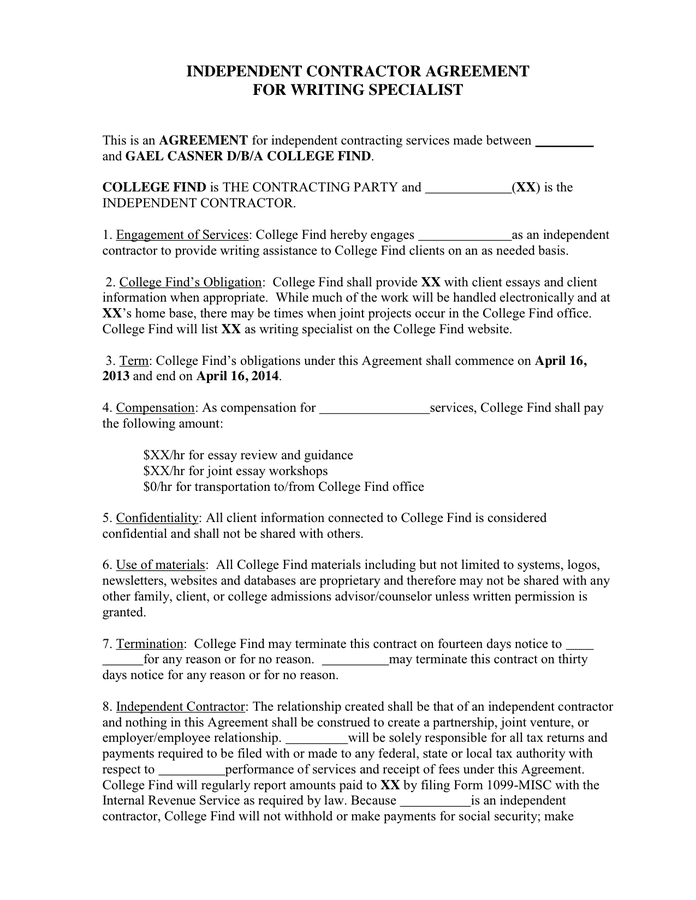

1099 contractor form editable-A 1099 contractor, also known as an independent contractor, is a classification assigned to certain US workers The "1099" reference identifies the tax form that businesses must file with the Internal Revenue Service ( IRS ), and it relieves the employer from the responsibility of withholding taxes from the individual's paychecksIndependent Contractor Agreement – Classified by the IRS as a 1099 Employee, is an individual or entity that is paid to perform a serviceExamples include contractors, medical professionals, attorneys, etc Download Adobe PDF, MS Word (docx), OpenDocument

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

11/3/21 1099 contractor form If you weren't selfemployed, your employer would send you a W2 form that lists your income and all the deductions that were withheld from your pay throughout the year, including federal, state, Social Security and Medicare taxes Once you know which contractors you paid over $600 to, you will need to fill out Form 1099NEC Starting at the upper left box, record your organization's name as the PAYER The PAYER TIN is the organization's tax identification numberPaying Taxes as an Independent Contractor You'll need to file a tax return with the IRS if your net earnings from selfemployment are $400 or more Call @ Skip to content help Support@form1099onlinecom 1099 Misc 7 Changed to 1099 NEC IRS 1099 K Form 21

Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or tradeCompensation The 1099 is an IRS form that an independent contractor receives stating her income from a given business during a given tax year The 1099 contractor is usually not protected by minimum wage laws; A Form 1099MISC is an IRS form that reports nonemployee compensation In addition to reporting compensation to freelancers and contractors, this form covers received income that spans the gamut from rents and crop insurance proceeds to prizes and awards, medical and health care payments, and any fishing boat proceeds

A 1099 form is a tax form used for independent contractors asset2 soup All pdf printa ble 1099 mis c ta x forms printable 1099 misc tax forms download printable 1099 misc tax forms create 14 printable 1099misc forms in pdf format to report income, 1099 employee compensation and rents to the irs during 15 tax1/4/21 A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the company30/4/21 Filing a 1099 Tax Form is required for an international contractor under two specific conditions When the contractor is located internationally but is a US citizen The contractor lives abroad but belongs to the US and still performs work in the United States

Create An Independent Contractor Agreement Download Print Pdf Word

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

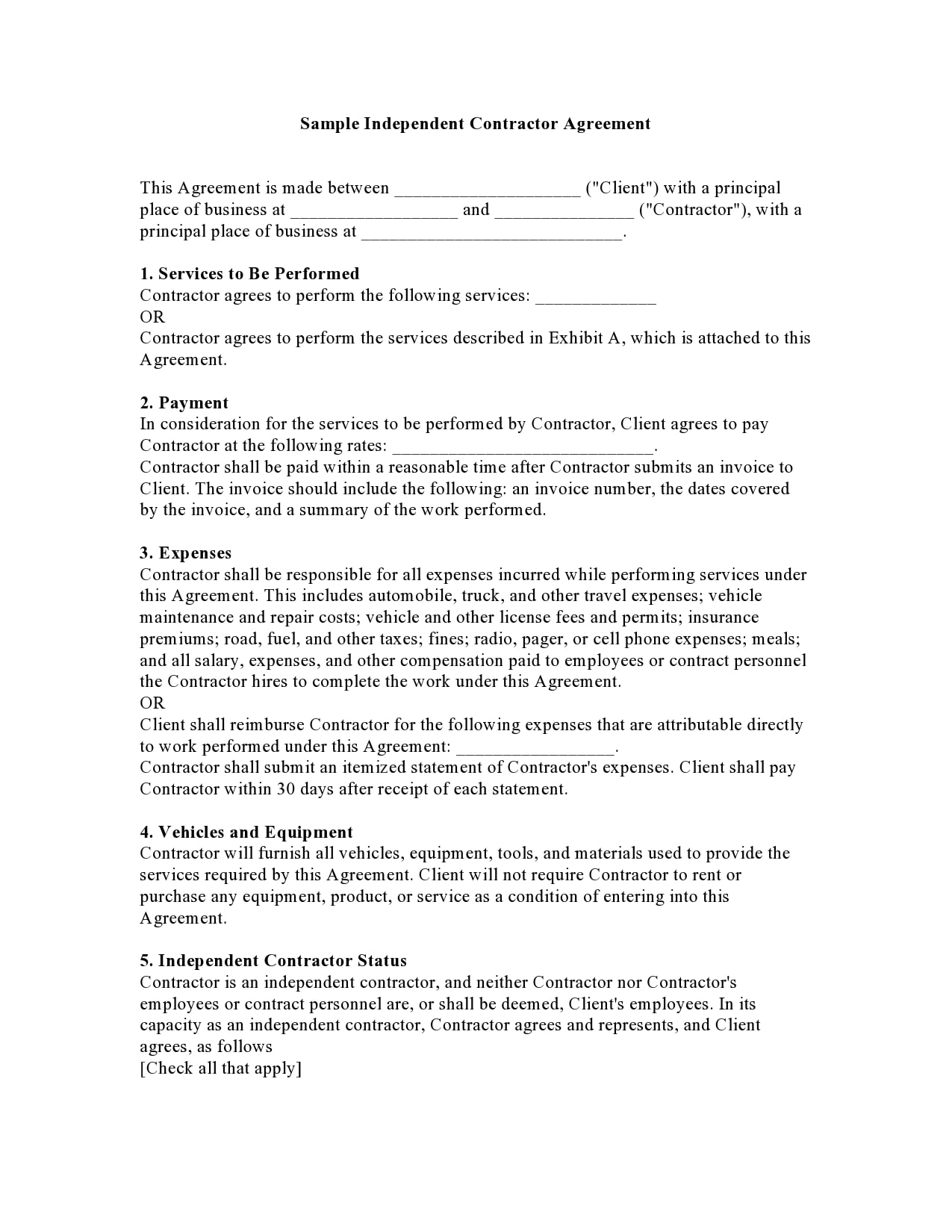

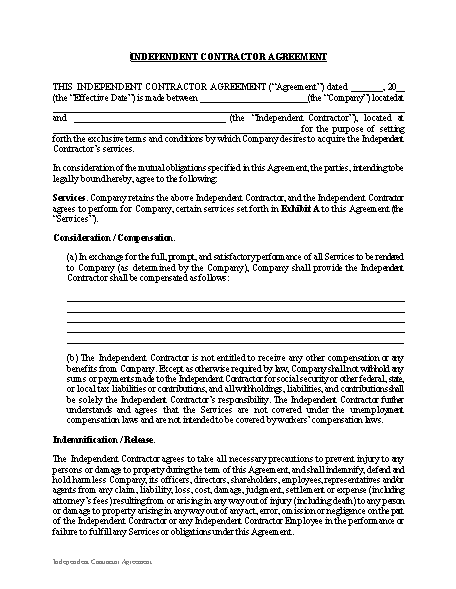

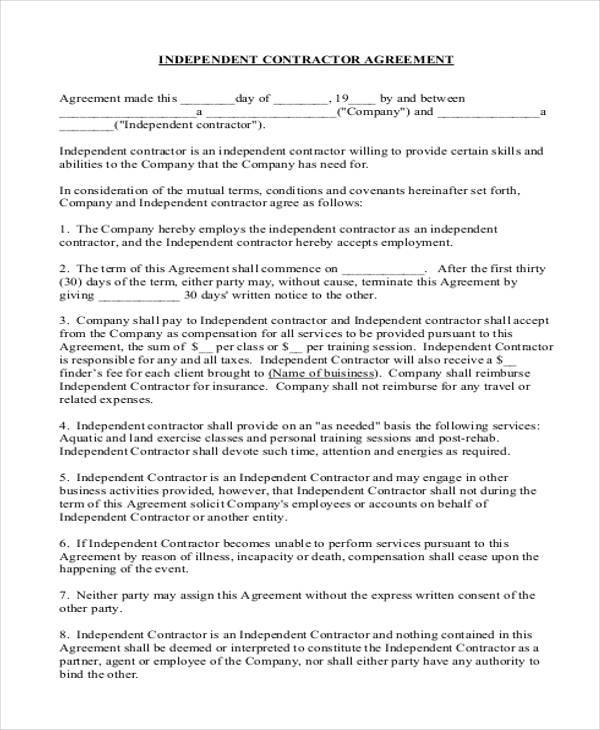

How to fill out 1099MISC Form Independent Contractor Work Instructions Example Explained Write Quickly and Confidently GrammarlyThe answer to this question is almost always 1099 form Usually, 1099 independent contractors and W2 employees are two totally different tax classifications As an employer, you have fewer tax responsibilities for a 1099 independent contractor than a W2 employee19/1/09 Agreement for Independent (IRS Form 1099) Contracting Services _____, referred to as CONTRACTING PARTY, and _____, referred to as INDEPENDENT CONTRACTOR, agree INDEPENDENT CONTRACTOR shall perform the following services for CONTRACTING PARTY _____

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

25/9/17 Form 1099MISC is used when the income arises from miscellaneous sources and amount of payment exceeds 600$ The link for the form is attached here for you Form 1099MISC is received by the individuals who are either selfemployed or worked as an independent contractor during the previous yearThe Form 1099 has many variations Contractors will often receive a 1099MISC form from a customer when the earnings (or revenue) from that one customer exc8/7/ Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer

Contractor Form Fill Online Printable Fillable Blank Pdffiller

Free Florida Independent Contractor Agreement Pdf Word

Tax filed by selfemployed individuals to the IRS for earning income apart from regular salary from a single employer considered as "Selfemployment tax" Form 1099NEC is due to your contractors and the IRS by January 31st of the following tax year If this date falls on a weekend or holiday, the filing deadline moves to the following business day For the tax year, Form 1099NEC will be due to the IRS February 1st, 21, as falls on a Sunday16/3/21 Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)

Printable Blank Contract Template

Independent Contractor Agreement Template Free Pdf Sample Formswift

The Form 1099NEC is used by the IRS to determine taxable income acquired by contractors and freelancers It is used to report payments a company made to an independent contractor within a tax year A company will need to submit this form as long as it has paid an independent contractor more than $600 in a tax yearAs a 1099 contractor, you're typically responsible for quarterly and annual taxes The easiest way to lower your taxes is to track your mileage and expenses using an app like Everlance Meet Everlance , the #1 mileage & expense tracker While you may have heard the term "1099 employee," it's a misnomer a 1099 employee technically doesn't exist because employees are classified differently than independent contractors—and it's contractors who use the 1099 form 1099 contractors can often add just the extra burst of talent and speed you're looking for

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

A 21 Guide To Taxes For Independent Contractors The Blueprint

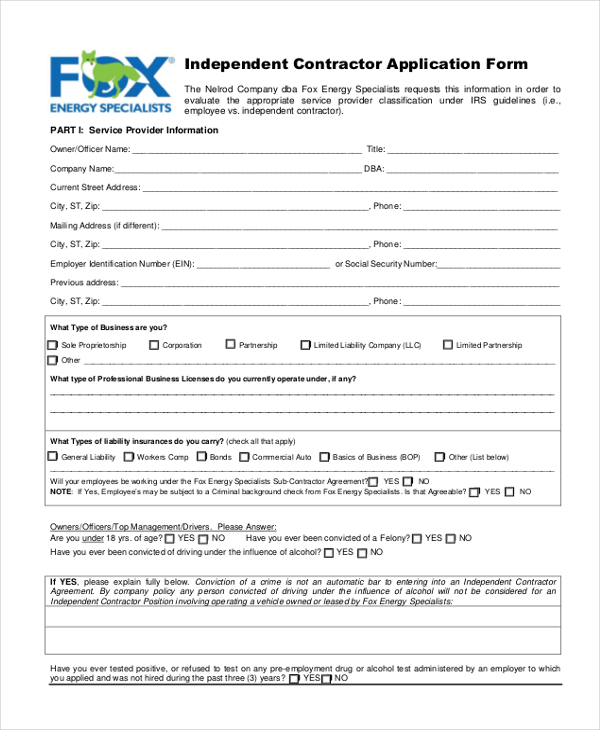

Form W9 lets employers collect the name, address, and Social Security Number (or Tax Identification Number, known as TIN) of the 1099 contractor in question Keep in mind that sometimes contractors acting as business owners might give you their Employer Identification Number (EIN) instead9/4/21 Independent contractors receive 1099 Tax Form at the yearend for performing work throughout the tax year What is a selfemployment tax? For contractor income it is best to use 1099NEC instead of 1099MISC The 1099NEC is new for tax filing year If you paid contractors previously using 1099MISC, we suggest moving to the new 1099NEC The 1099NEC makes your filing very specific about the type of payment (in this case, contractor income or other service income you paid)

What Tax Forms Do I Need For An Independent Contractor Legal Io

Form 1099 Misc Vs Form 1099 Nec How Are They Different

17/8/21 Form 1099MISC is oftentimes mandatory and commonly used by businesses to report other income payments to freelancers and independent contractors If you're not going to use Form 1099MISC other than this purpose, consider filing Form 1099NEC as it's simpler, and you won't need to file multiple Forms 10964/4/19 Taxpayers will receive a Form 1099 via mail if they worked during a given year as a 1099 contractor, and individuals will need to accurately report all 1099 information on their yearly tax return Unlike a standard W2 form, in which an employer files and withholds the appropriate tax dollars on an employee's behalf, for all intents and purposes a 1099 contractor is her or hisThe Form 1099MISC will still be used to report payments for such things as rent, medical payments, consumer goods for resale, and royalties Just like with the Form 1099MISC, the Form 1099NEC is not used to report payments of less than $600 over the course of a year If a client business pays the independent contractor less than $600 they

Free Independent Contractor Agreement Template What To Avoid

What Is A 1099 Contractor With Pictures

You don't need to file Form 1099 for a contractor registered as a corporation You can see whether a contractor is incorporated based on the information on their Form W9 Request one from any contractor as soon as you hire them Also keep in mind that corporation names are typically appended with ", inc" Don't file 1099s for employees1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA each Project by the execution by Eastmark and Contractor of a Work Order in the form attached to W9s and 1099s are tax forms that businesses need when working with independent contractors Form W9 is what an independent contractor fills out and provides to the employer Form 1099 has

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

You need to report the form 1099 – NEC if you received any service from a nonemployed contractor/vendor, and the stated value of that service was $600 or above during the year You should also file the form 1099 – NEC if you have received any service from a nonemployed contractor or vendor, with a value above $600, whom you also reported last year on the 1099 –30/8/21 Should you give an independent contractor W2 or 1099 form?So, whom to send out a Form 1099 depends on the type of the business you do and the type of the contractor you're dealing with Form 1099 MISC If you pay a contractor more than $600, then the contractor is eligible to receive a 1099 MISC Or else when you pay $10 or more in royalties, you've to send this Form IRS Form 1099 INT

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

Free 9 Sample Independent Contractor Forms In Ms Word Pdf Excel

24/2/21 A 1099 is a tax form that is used to record nonemployee income The 1099MISC form is often considered a catchall for income that doesn't fit into other categories However, the most popular use of 1099s is reporting independent contractor payments for services provided to a business QuickBooksIndependent contractors will then use the information on this 1099 Form to file their tax returns If you are just a truck driver driving on your own, or a leased driver, you'll also need the 1099 Form, which is also known as the 1099 contractor form As a driver, if you own or lease your truck, you could be an independent contractorThe tips below will allow you to complete 1099 Contractor Form quickly and easily Open the form in the fullfledged online editing tool by hitting Get form Fill out the required fields which are yellowcolored Hit the arrow with the inscription Next to move on from box to box Go to the eautograph tool to esign the form Add the date

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Rules For Business Owners In 21 Mark J Kohler

The primary tax form received by an independent contractor is Form 1099MISC If you performed work for a person or business as an independent contractor, you will receive this form at the same time that employees receive W2 forms They usually arrive around the end of January following the tax year1/7/21 Even small businesses must classify and organize their form 1099 to avoid any tax troubles Here are a few methods to keep track of employment tax and organizing your form 1099 1 Label receipts While it may look like a small business or an independent contractor can only incur so many expenses, they may multiply without enough anticipation8/1/21 The contractor comes in and completes the job, and they operate as a sole proprietorship, charging you $5,000 for the completed job So in this example, it would be your responsibility to send the contractor a Form 1099NEC, stating the exact amount paid to the contractor, and the services rendered to you You will also file a copy to the IRS

3

2

©21 by Undisputed Trucking Services LLC Proudly created with WixcomUntil , Form 1099MISC was used to report payments including those paid to contractors, freelancers, and individuals for services rendered However, differing due dates created loopholes for bad actors to abuse the system As of 21, the IRS reinstated the use of Form 1099NEC to report all payments made to nonemployee individuals forThis webinar will cover the new Form 1099NEC, last seen in 19 This is the new form for reporting contract labor In addition to discussing the new form, we will talk about how to know if someone is a contractor or an employee, and whether or not reimbursements to contractors are reportable We'll also cover Form 1099MISC changes, and also the

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

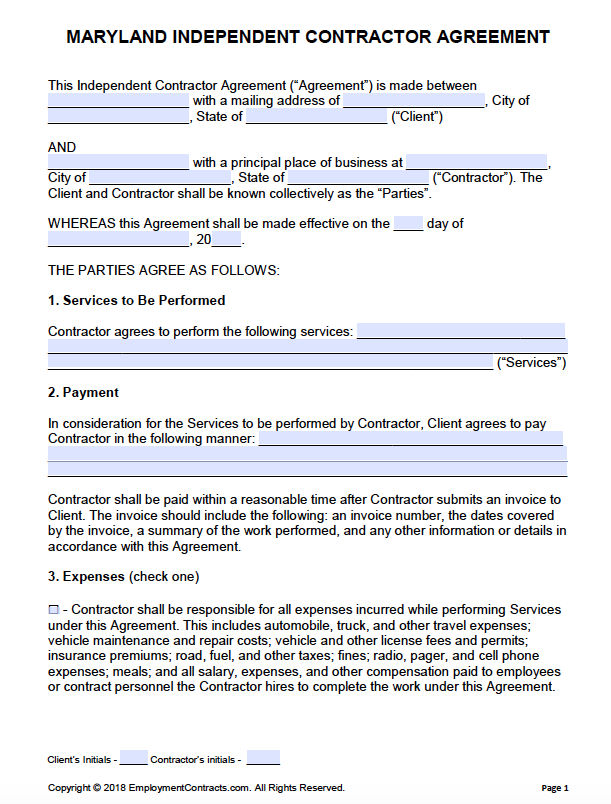

Free Maryland Independent Contractor Agreement Pdf Word

Instant Form 1099 Generator Create 1099 Easily Form Pros

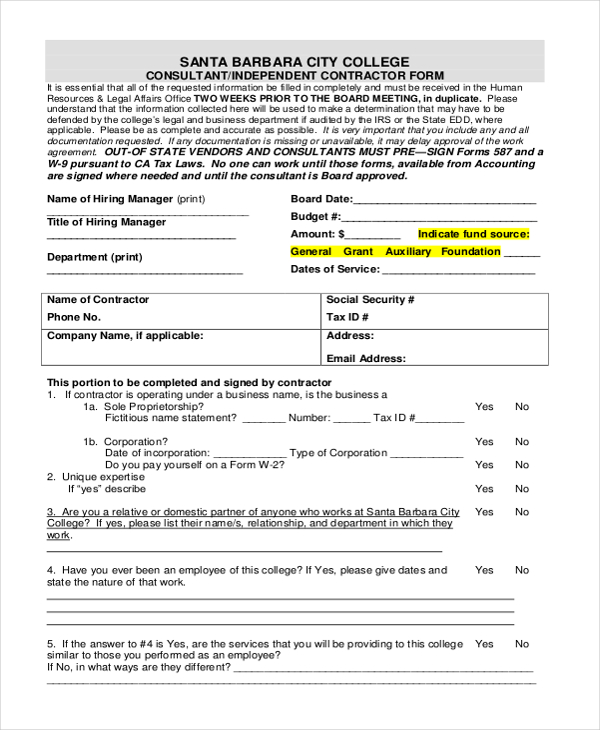

34 Printable Sample Independent Contractor Agreement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

What Is The 1099 Form For Small Businesses A Quick Guide

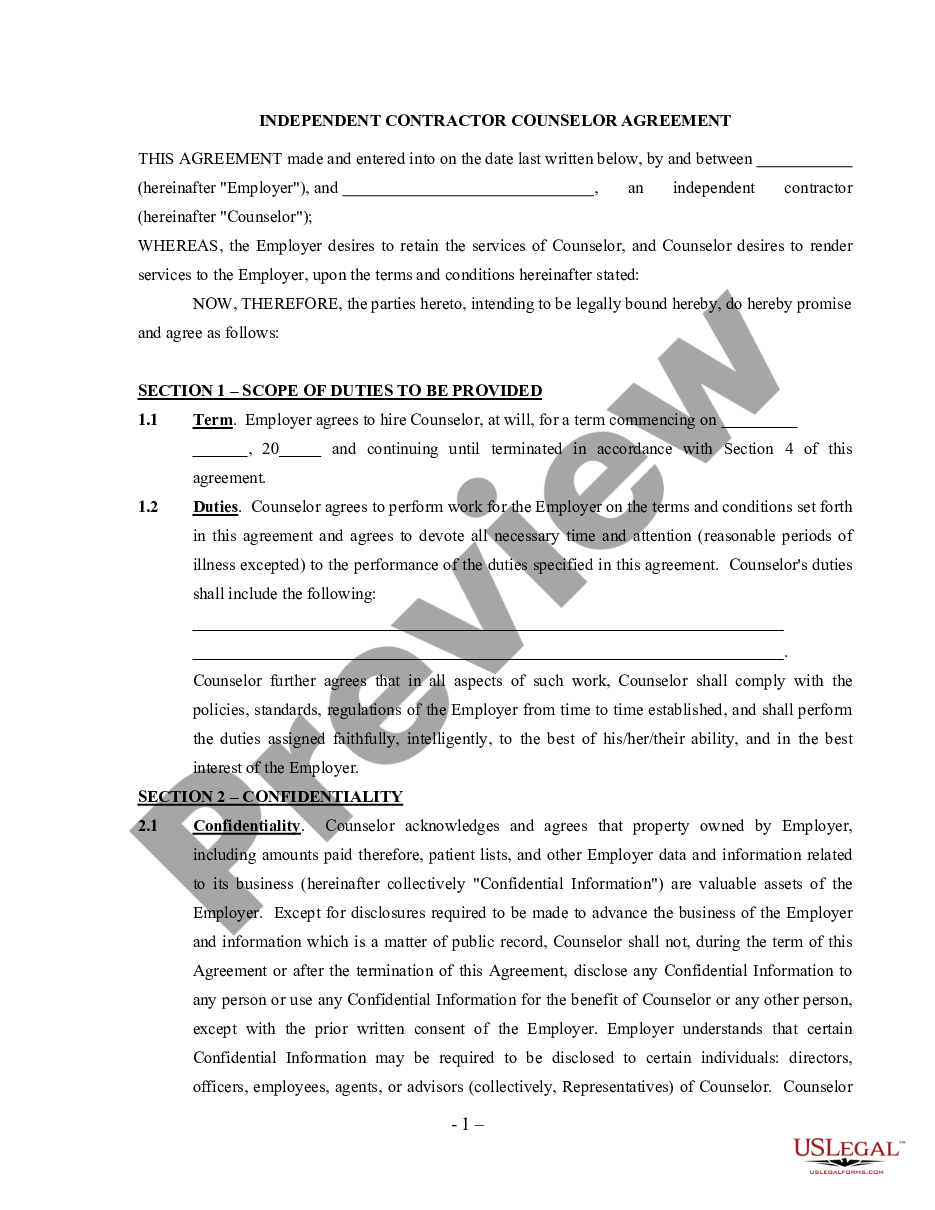

Counselor Agreement Self Employed Independent Contractor Mental Health Therapist Contract Agreement Us Legal Forms

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Irs 1099 Misc Form For 21 Form 1099 Online By Form1099 Issuu

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

3

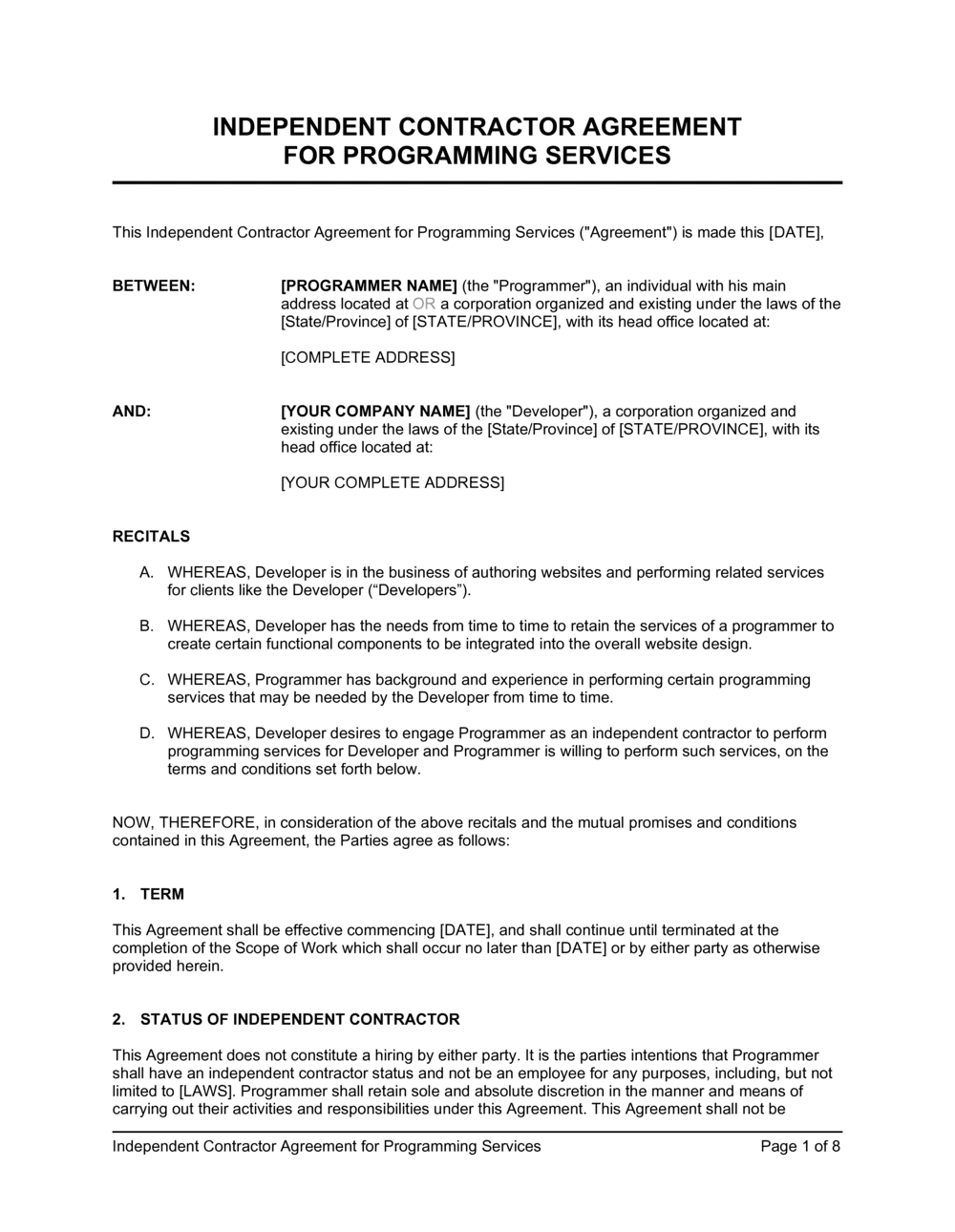

Independent Contractor Agreement For Programming Services Template By Business In A Box

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Free 9 Sample Independent Contractor Forms In Ms Word Pdf Excel

1099 G California

2

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

Who Receives A Form 1099 Misc

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

I Received A Form 1099 Misc What Should I Do Godaddy Blog

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Invoice Template Best Of 10 Independent Contractor Invoice Template Invoice Template Dental Hygiene Resume Templates Estimate Template

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Consultant Agreement In Word And Pdf Formats

1099 Contractor Document Form Independent Icon Download On Iconfinder

Independent Contractor 101 Bastian Accounting For Photographers

1099 Form Independent Contractor Free

Independent Contractor Agreement Example

Independent Contractor 101 Bastian Accounting For Photographers

Misc E File 1099 Misc Onlinefiletaxes Com

3

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

1099 Misc Or 1099 Nec What You Need To Know About The New Irs Requirements Northeast Financial Strategies Inc

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

2

W 2 And A 1099 Here S What To Know Trinity Global Financial Group

Free Independent Contractor Agreement Pdf Word

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

Walk Through Filing Taxes As An Independent Contractor

50 Free Independent Contractor Agreement Forms Templates

30 Simple Independent Contractor Agreements 100 Free

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Form 1099 Nec For Nonemployee Compensation H R Block

Independent Contractor Agreement Example Word Document Short Form Texas

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Your Ultimate Guide To 1099s

1099 Form Independent Contractor Agreement

50 Free Independent Contractor Agreement Forms Templates

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

What Are Irs 1099 Forms

Form 1099 Misc It S Your Yale

2

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Who Are Independent Contractors And How Can I Get 1099s For Free

1099 Misc Instructions And How To File Square

Form 1099 Misc 21

1099 Misc Form Fillable Printable Download Free Instructions

Free Independent Contractor Agreement Free To Print Save Download

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Contractors Contract Template Fill Online Printable Fillable Blank Pdffiller

Irs Launches New Form Replacing 1099 Misc For Contractors In Cpa Practice Advisor

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Free California Independent Contractor Agreement Word Pdf Eforms

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Free Independent Contractor Agreement Templates Word Pdf

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

1099 Misc Form Reporting Requirements Chicago Accounting Company

Independent Contractor Agreement

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Free Texas Independent Contractor Agreement Pdf Word

Form W 9 Vs Form 1099

What Is Form 1099 Nec

Independent Contractor Agreement In Word And Pdf Formats

Independent Contractor Agreement In Word And Pdf Formats

My Employer Says I M An Independent Contractor Does L I Cover Me

0 件のコメント:

コメントを投稿